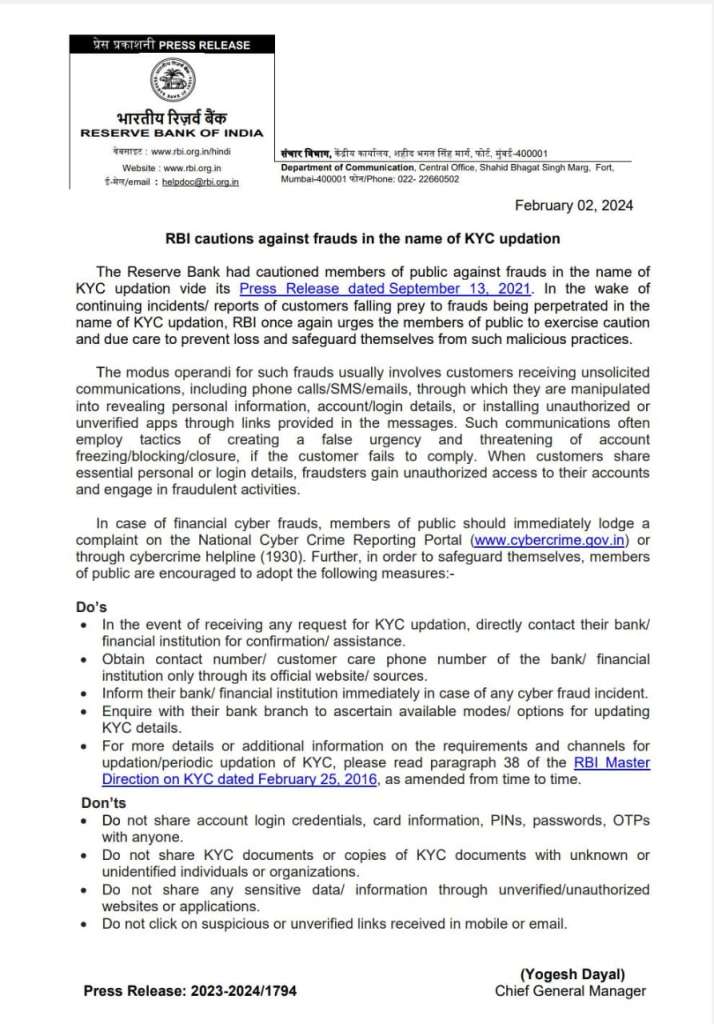

The Reserve Bank of India (RBI) has issued a cautionary notice on February 2 , 2024 , regarding fraudulent activities related to Know Your Customer (KYC) updation. This report aims to outline the modus operandi of such frauds and provide guidelines to safeguard against them.

In a Press Release dated September 13, 2021, the RBI alerted the public to fraudulent schemes operating under the guise of KYC updation. Despite previous warnings, incidents of customers falling victim to such scams persist.

The RBI reiterates the importance of vigilance and prudent measures to prevent financial loss and protect against malicious practices.

As per the RBI Report , Fraudulent activities typically involve unsolicited communications via phone calls, SMS, or emails, enticing customers to disclose personal information, account details, or install unauthorized applications through provided links. Perpetrators often employ tactics inducing a sense of urgency or threat of account suspension to coerce compliance. Once customers divulge sensitive information, fraudsters gain unauthorized access to their accounts, facilitating fraudulent transactions.

To combat financial cyber fraud, RBI has advised all individuals to promptly report incidents to the National Cyber Crime Reporting Portal or the cybercrime helpline (1930).

In this report RBI also given some of the following precautionary measures which can be endorsed to get rid of such kind of scams and RBI also notified a list of Do’s & Don’ts –

Do’s:

- Directly contact the bank or financial institution to verify any requests for KYC updation.

- Obtain contact details solely from official sources or the institution’s website.

- Promptly inform the bank of any cyber fraud incidents.

- Consult the bank branch to explore available KYC updation methods.For comprehensive guidelines on KYC requirements and procedures, individuals are directed to refer to paragraph 38 of the RBI Master Direction on KYC (February 25, 2016, amended periodically).

Don’ts:

- Refrain from sharing account login credentials, card information, PINs, passwords, or OTPs with third parties.

- Avoid sharing KYC documents with unknown entities or organizations.

- Exercise caution when sharing sensitive information online and avoid unverified websites or applications.

- Do not click on suspicious or unverified links received via mobile or email.

The RBI underscores the imperative of remaining vigilant against fraudulent activities masquerading as KYC updation requests. By adhering to recommended precautions and promptly reporting suspicious incidents, individuals can mitigate the risk of falling victim to financial cyber fraud.For Further Information Interested parties are encouraged to refer to official RBI publications and directives regarding KYC procedures and fraud prevention measures.